The Hidden Costs of “Build”: Why Buying the Right Solution Just Makes Sense

There’s always been a buzz around the "Build vs. Buy" debate when it comes to...Read More ›

For an insurance company, fulfilling their promise to their policyholders is really the hallmark of their business. In fact, 87% of claimants say that their claims experience directly impacts their decision to do business with the insurance provider.

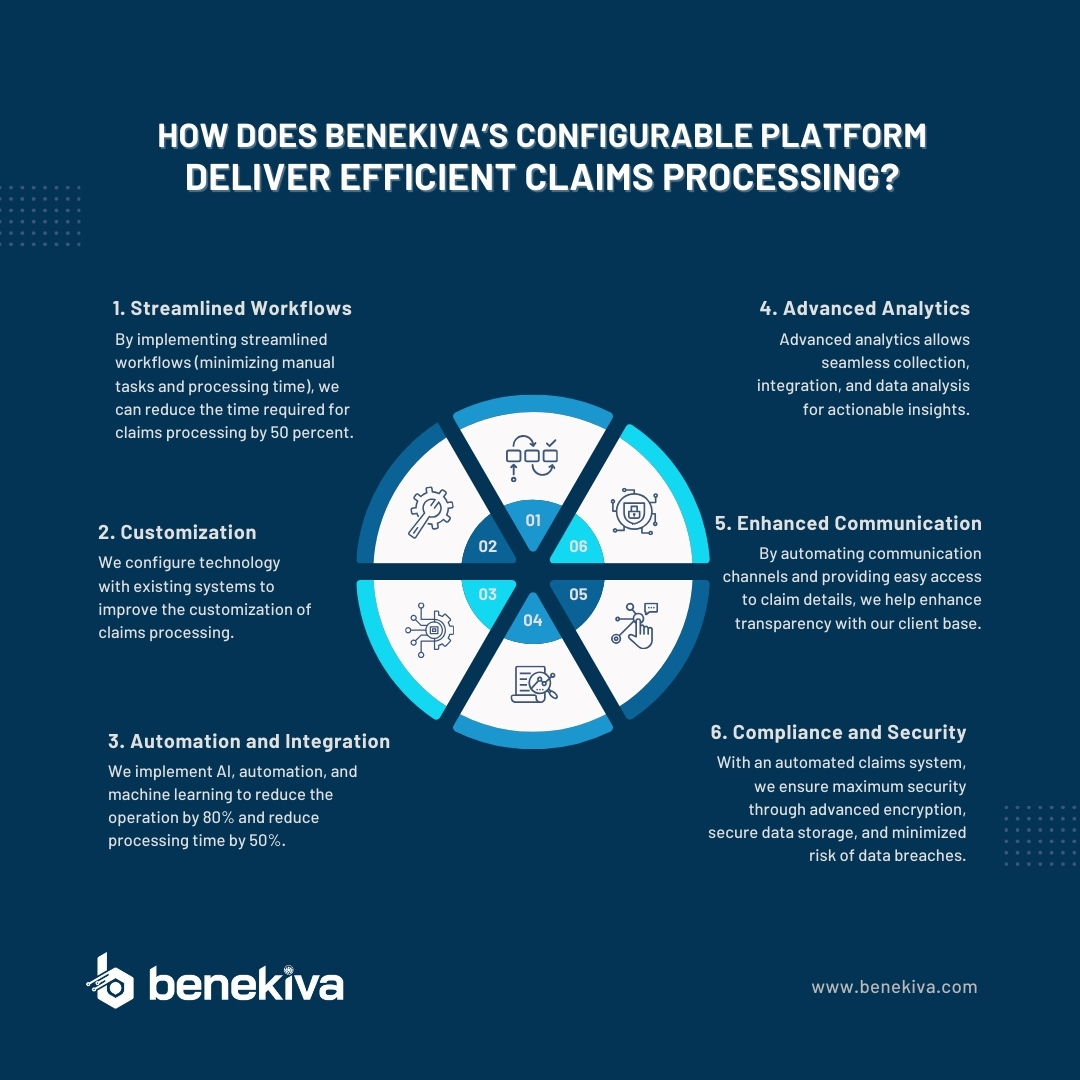

Benekiva’s configurable platform revolutionizes the claims processing experience, delivering unparalleled efficiency and effectiveness. With our innovative technology, insurance companies can streamline their workflows, customize to specific needs, automate and integrate, enhance compliance and security, and provide advanced analytics and communication to provide faster and more accurate claim settlements.

Did you know 61% of consumers prefer digital tools to monitor their claims processing and application status?

The configurable platform offered by Benekiva revolutionizes the way insurance companies handle claims processing, enabling them to achieve optimal efficiency.

Our solution ensures seamless end-to-end processing, from automated data entry and document management to intelligent workflows and real-time analytics.

This not only accelerates the processing time but also enhances accuracy and reduces the risk of errors or fraud.

Here is how our platform facilitates efficient claims processing.

With the manual system, insurance companies cannot manage tasks or distribute work to the right resources.

Right from submission of the claim to payment of a reimbursement, customers expect complete transparency and speed that manual claims processing cannot provide.

Implementing streamlined workflows can dramatically reduce the time required for claims processing.

Studies have shown that companies using advanced claims management systems can achieve up to a 50% reduction in processing time, leading to faster claims resolution and improved customer experience.

This eliminates manual tasks, reduces processing time, and minimizes the risk of errors.

The configurable platform offered by Benekiva streamlines workflows in several ways, optimizing the entire claims processing journey.

Here is how the platform achieves this-

Due to these reasons, workflow automation is a great way to streamline claims processing.

The platform provides configurable workflows that automate and streamline the claims process, from submission to settlement.

This results in improved operational efficiency, faster turnaround times, and enhanced customer satisfaction.

Insurance companies can tailor the platform to match their specific business requirements.

They can define rules, workflows, and data fields according to their processes, ensuring seamless integration with existing systems and enhancing overall efficiency.

According to a study by PwC, 73% of customers expect an insurance company to offer real-time interactions and personalized services.

The configurable platform provided by Benekiva empowers insurance companies to customize their claims processing according to their unique business requirements.

Here is how the platform enables customization

The configurable platform enables insurance companies to adapt the claims processing system to their specific needs by offering extensive customization capabilities.

This customization enhances efficiency, accuracy, and compliance, ultimately improving the insurance company’s and its customers’ overall claims processing experience.

The platform integrates with various data sources, allowing for automated data entry and retrieval.

Did you know automation can reduce manual work by 80% and claims processing time by up to 50%?

This eliminates the need for manual data entry and reduces the chances of inaccuracies. Integration with document management systems also ensures the smooth handling of claim-related documents.

The configurable platform provided by Benekiva enables automation and integration in claim processing through various features and functionalities.

Here is how the platform achieves this

This ultimately leads to faster and more effective claim resolution, improved customer satisfaction, and increased operational efficiency for insurance companies.

Check this infographics our for information

According to Deloitte, advanced analytics can improve decision making and reduce costs by up to 50%.

The platform provides real-time analytics and reporting capabilities, offering valuable insights into claims performance.

Insurance companies can monitor key metrics, identify trends, and make data-driven decisions to optimize their claims processes and enhance efficiency.

The configurable platform provided by Benekiva empowers insurance companies with advanced analytics capabilities to enhance claim processing.

Here is how it enables advanced analytics.

With advanced analytics, the configurable platform empowers insurance companies to gain actionable insights, improve decision-making, enhance operational efficiency, and optimize their claim processing workflows.

Furthermore, it helps identify opportunities for process improvement, reduces costs, enhances customer satisfaction, and ultimately drives business growth.

About 71% want to process claims through digital platforms, like voice or chat, instead of in person.

By automating communication and providing easy access to claim details, insurers can enhance transparency and build customer trust.

It facilitates seamless communication between insurers, claims adjusters, and policyholders. It enables policyholders to submit claims online, track the status of their claims, and receive timely updates, improving transparency and customer satisfaction.

Here is how Benekiva’s configurable platform enhances communication in claim processing.

The configurable platform ensures smooth and transparent stakeholder communication throughout the claim processing journey.

Besides, it improves customer satisfaction, reduces communication errors, minimizes delays, and leads to more efficient and effective claim resolution.

According to the insurtech Cowbell, 91% of small and medium-sized firms in the United States with cyber insurance plans received assistance from their policy provider to avoid cyber incidents.

Automatic claims systems implement encryption, secure data storage, and access controls to safeguard customer data, reducing the risk of data breaches and ensuring compliance with data protection regulations.

The configurable platform offered by Benekiva enhances compliance and security in claim processing through various mechanisms and features.

By staying updated with the latest security measures, the platform ensures ongoing protection and reduces the risk of security breaches.

This ensures a secure and compliant environment for claim processing, giving stakeholders peace of mind and minimizing the risk of security incidents.

Experience the power of efficient claims processing with Benekiva’s configurable platform and unlock new levels of productivity and profitability for your insurance business.

By leveraging the configurable platform provided by Benekiva, an insurance claims management system, insurance companies can achieve efficient claims processing.

Furthermore, the intuitive user interface enables adjusters and claims professionals to navigate the system effortlessly, ensuring a smooth and productive experience.