Our Solutions

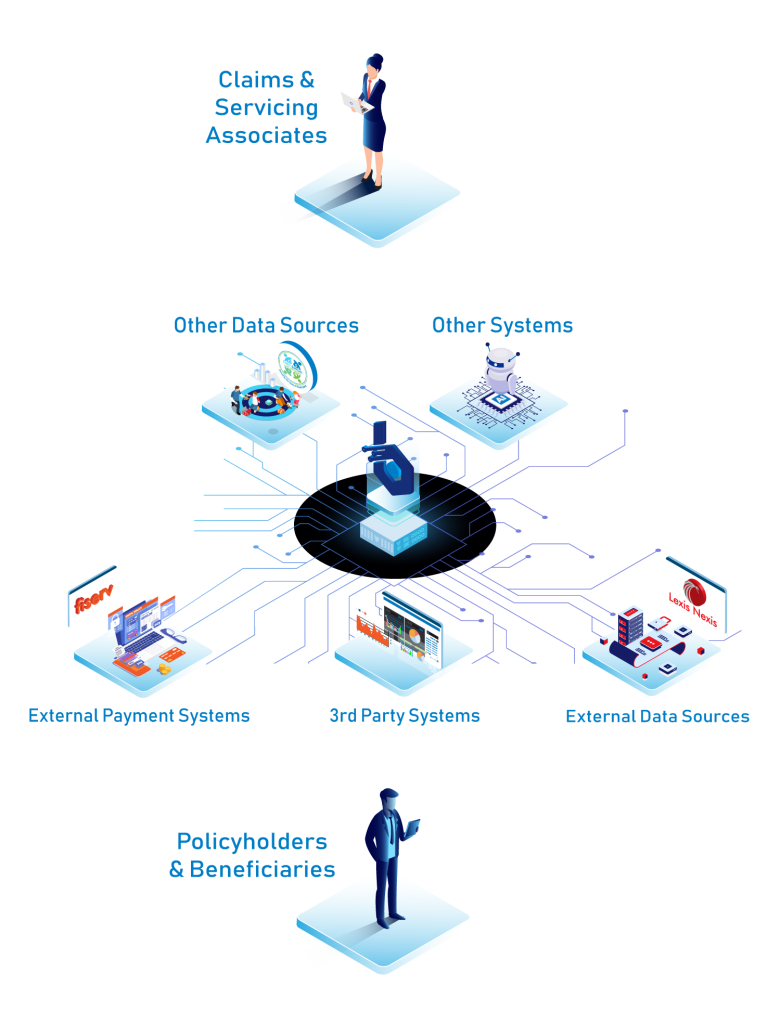

Empowering enhanced claims and servicing operations

with a customer-focused mindset

ACCESSIBILITY

Benekiva anywhere, anytime, and on any device™ accessibility

DYNAMIC WORKFLOWS

Enable work allocation / routing of items like approvals or large claim review

CONFIGURABLE TOOLS REDUCE COGNITIVE LOAD

Reduce manual burdens through proactive notitification alerts and built-in calculation engine

AUTO-ADJUDICATION ENGINE

Increase capacity for complex claims like annuity disbursements

ROBUST REPORTING ENGINE

Automate ALL reporting for informed decisions

RICH AUDIT CAPABILITIES

Support internal and external audit with configurable claim packets

CONFIGURABLE RULES ENGINE

Drive claim requirements, regulatory lookups, communications, correspondence, statements, payments, and complex processes such as contestable

INTUITIVE SELF-SERVICE INTERFACE

Enable FNOL and ALL related documents submitted electronically, eliminating NIGO and meeting claimants’ personal preferences

FLEXIBLE PAYOUT OPTIONS

Offer partial payments, repetitive pay, and scheduled pay

DIGITAL INTAKE AND SELF-SERVICE CAPABILITIES

Improve KPIs such as reduced NIGO rates, reduction in outbound call volumes and increased policy issue counts

RULES-BASED WORKFLOWS

Rules-based workflows enable straight-thru processing and increase staff capacity so they can focus on complex work

DECREASED TRAINING TIMES AND REQUIREMENTS

Requirements are pre-configured based on key parameters along with guided workflows and intuitive dashboards

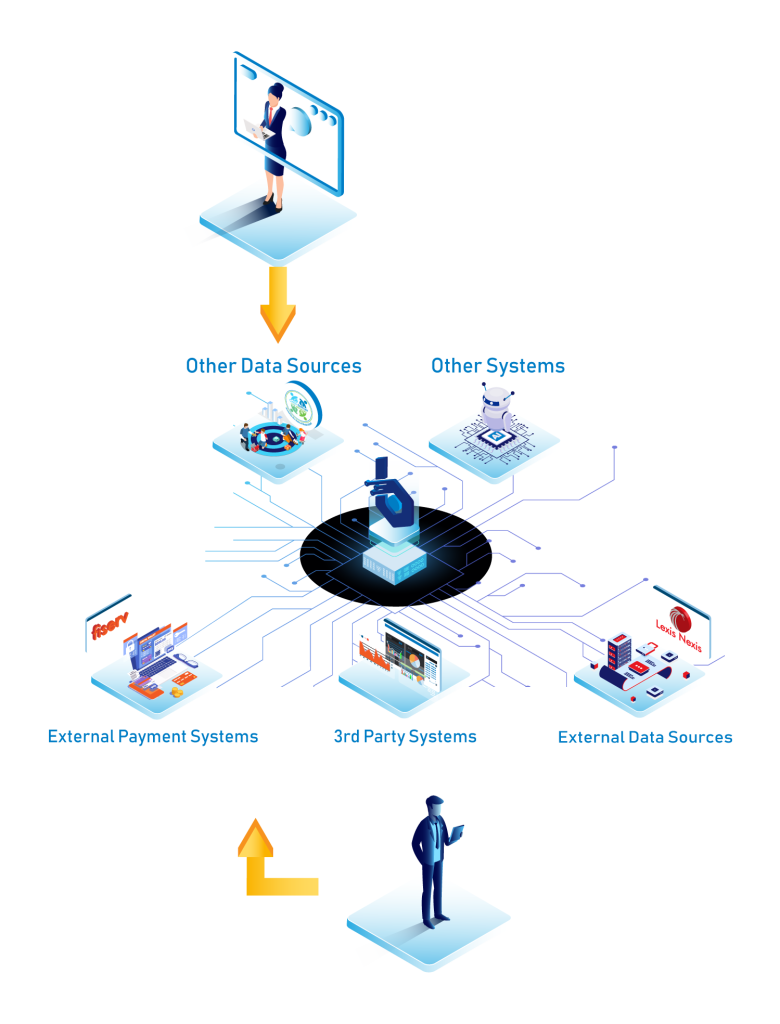

OMNICHANNEL COMMUNICATIONS SUPPORTED

Reduce back-and-forth because of seamless connectivity to external data or payment system sources

DIGITAL SELF-SERVICE CAPABILITIES WITH SECURE DOCUMENT ENCRYPTION

This means simple requests require little to no associate involvement

REFLEXIVE PHONE SCRIPTS

Guide staff and reduce friction between carrier and requester

FOCUS ON SECURITY

Secure, single sign-on, roles-based access, end-to-end encryption, single tenant networks/machines