How The Platform Works

A SINGLE-PLATFORM SOLUTION

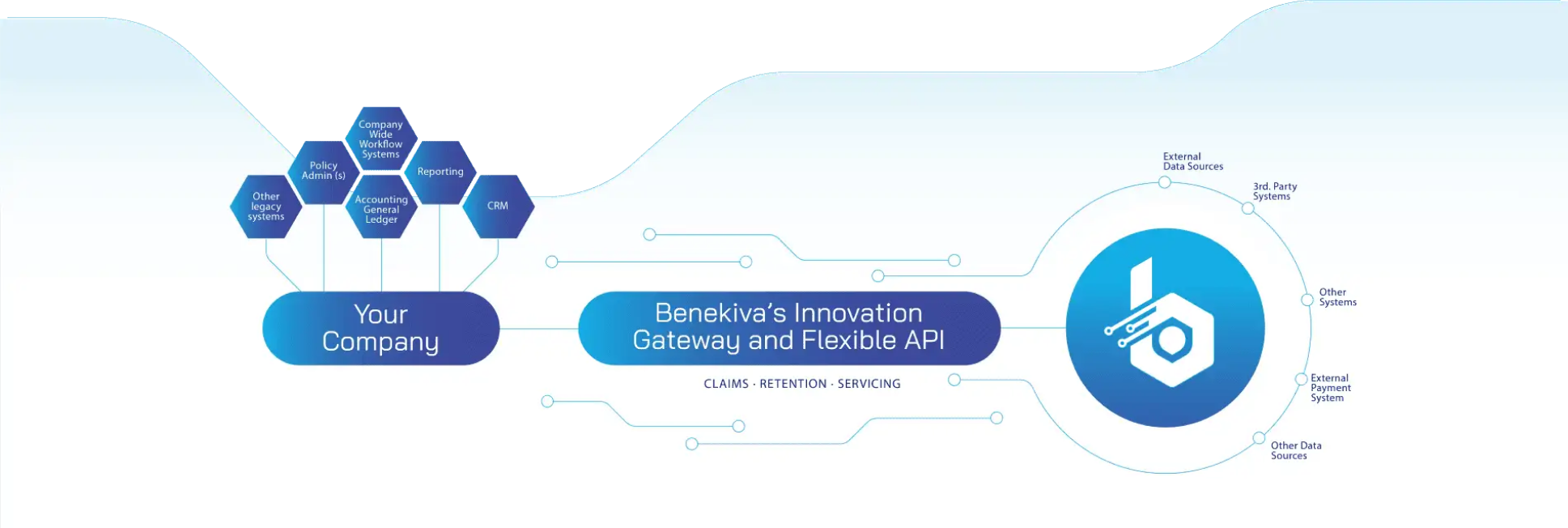

Frictionless Integrations Mean Carriers Realize the Value of Their Investment Sooner

A SINGLE-PLATFORM SOLUTION

INTEGRATE

AUTOMATE

ELEVATE

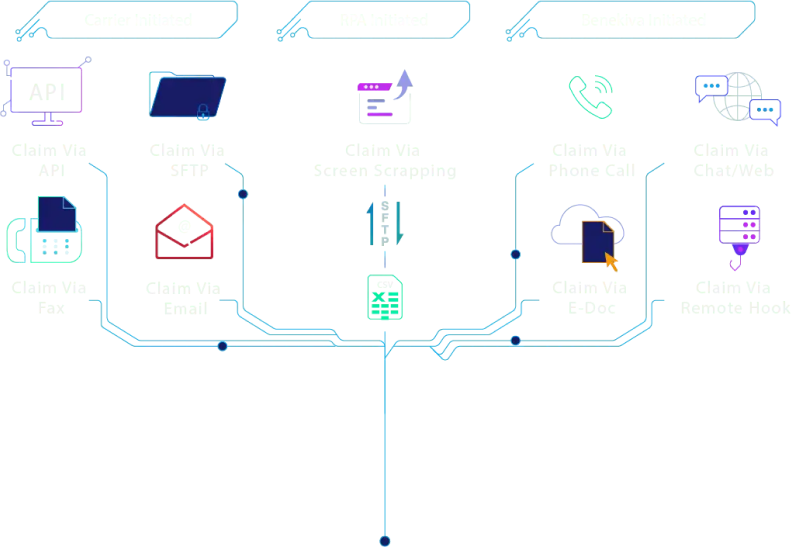

TAKE A PEEK AT OUR CLAIMS JOURNEY

FIRST CLAIM SEQUENCE

The first step is to acquire and assimilate claims received from various mediums to create a cohesive claim record.

This process identifies policy records and eligibility to be forwarded for FNOL and informs an insurance provider about policy claim activation.

CLAIMS WORKFLOW

The claims workflow follows automation and algorithm to initiate and process the claim.

Starting with receiving the claim intake form to assess whether it fulfills the requirement, each claim is assigned tags and remarks for further processing.

The files are assessed based on different criteria and forwarded for payment disbursement.

The payment is approved and reconciled, all in a handful of less-manual steps.

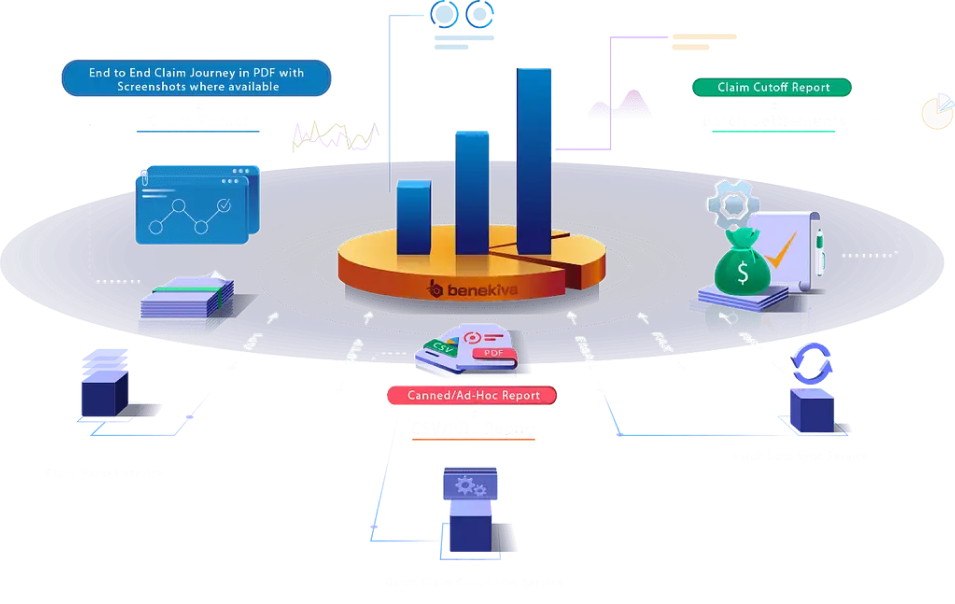

AUDIT REPORTS DATA

Each settled claim is audited for report data and stored in a claim packet, which can be downloaded in a readable format (CSV/PDF).

The system recognizes the settled claims to create batch settlements for record-keeping and future purposes.

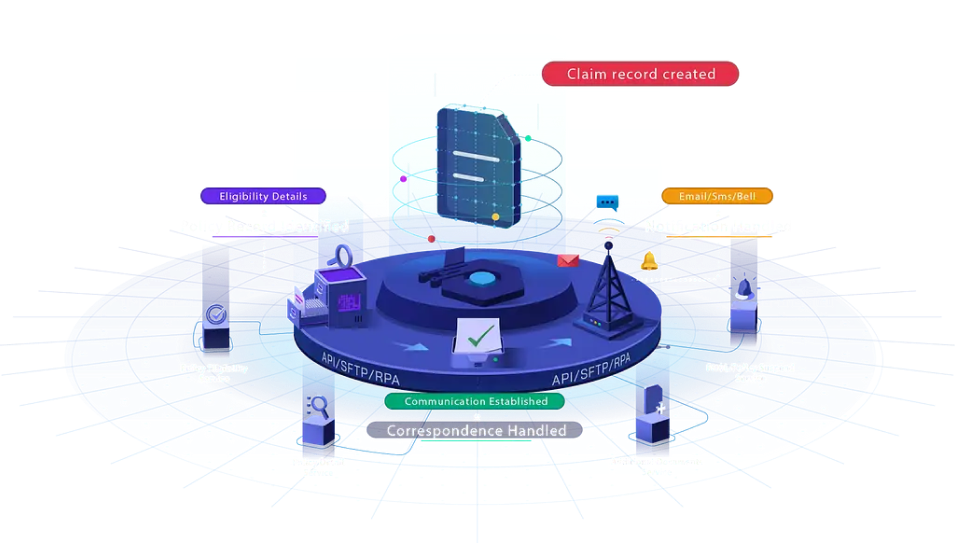

BRING EVERYTHING TOGETHER

It syncs all aspects, making any claim processing quicker, more efficient, and free of mistakes.

The idea lies in recognizing each department's effort in the making a claim processing quicker, starting from claims, IT automation, and third-party administrator to customer service.